Endorsed by Industry Experts

The Perfect Conversation Starter

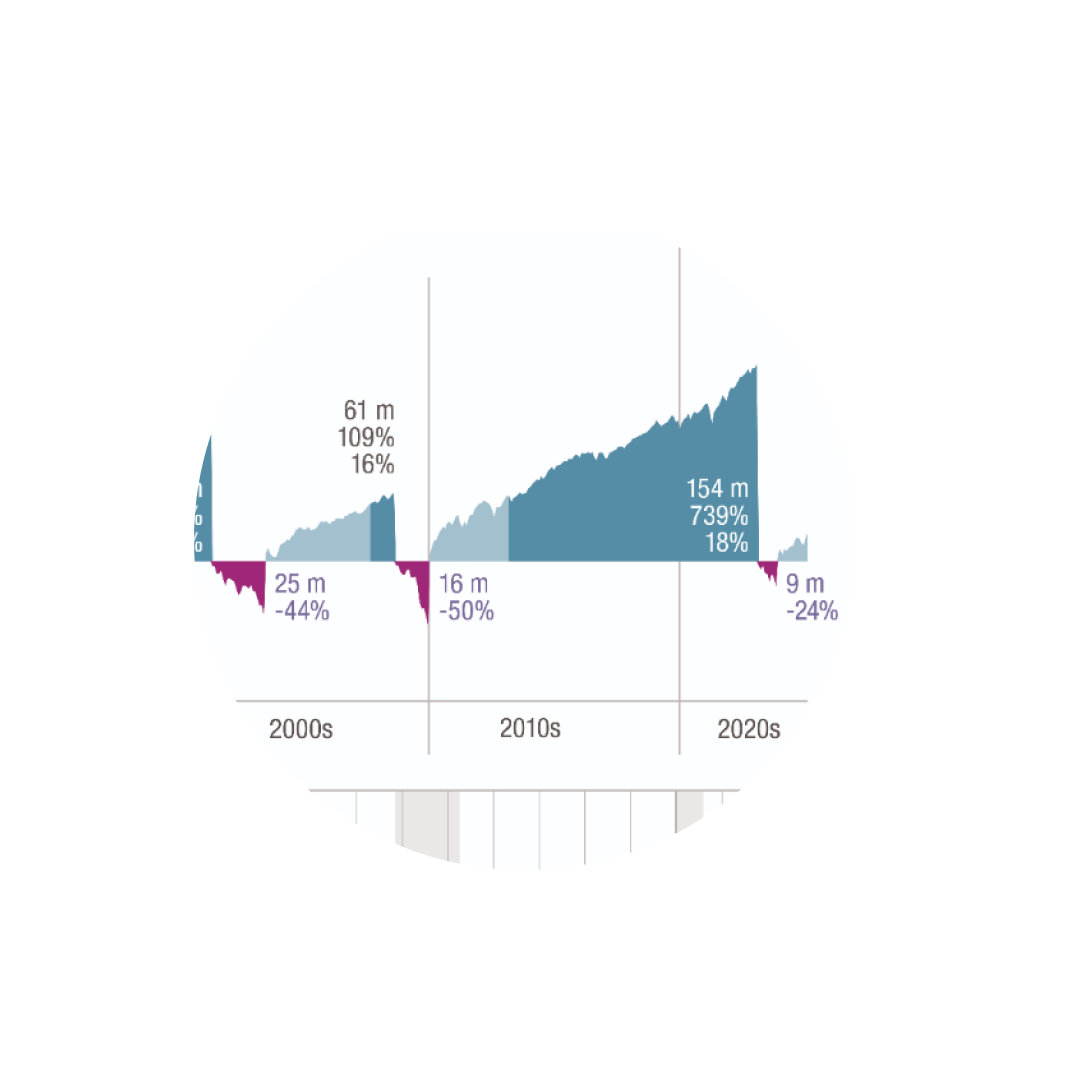

Downturns & Recoveries

Since 1926, stocks have fallen by over 20 percent on eight occasions, but following each downturn, they have recovered and gone on to reach new highs

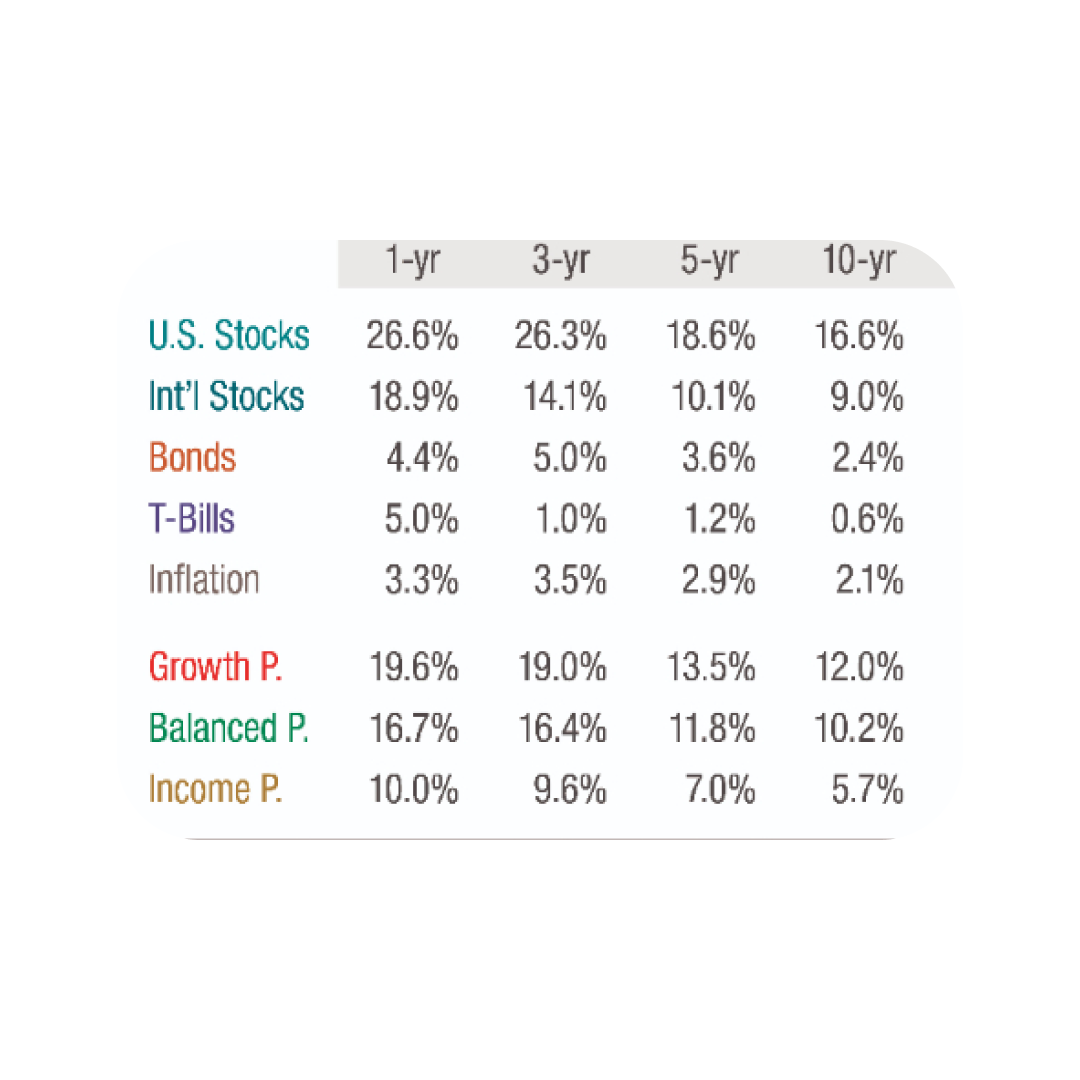

Diversification

Compare how different investment mixes have balanced returns and stability over time

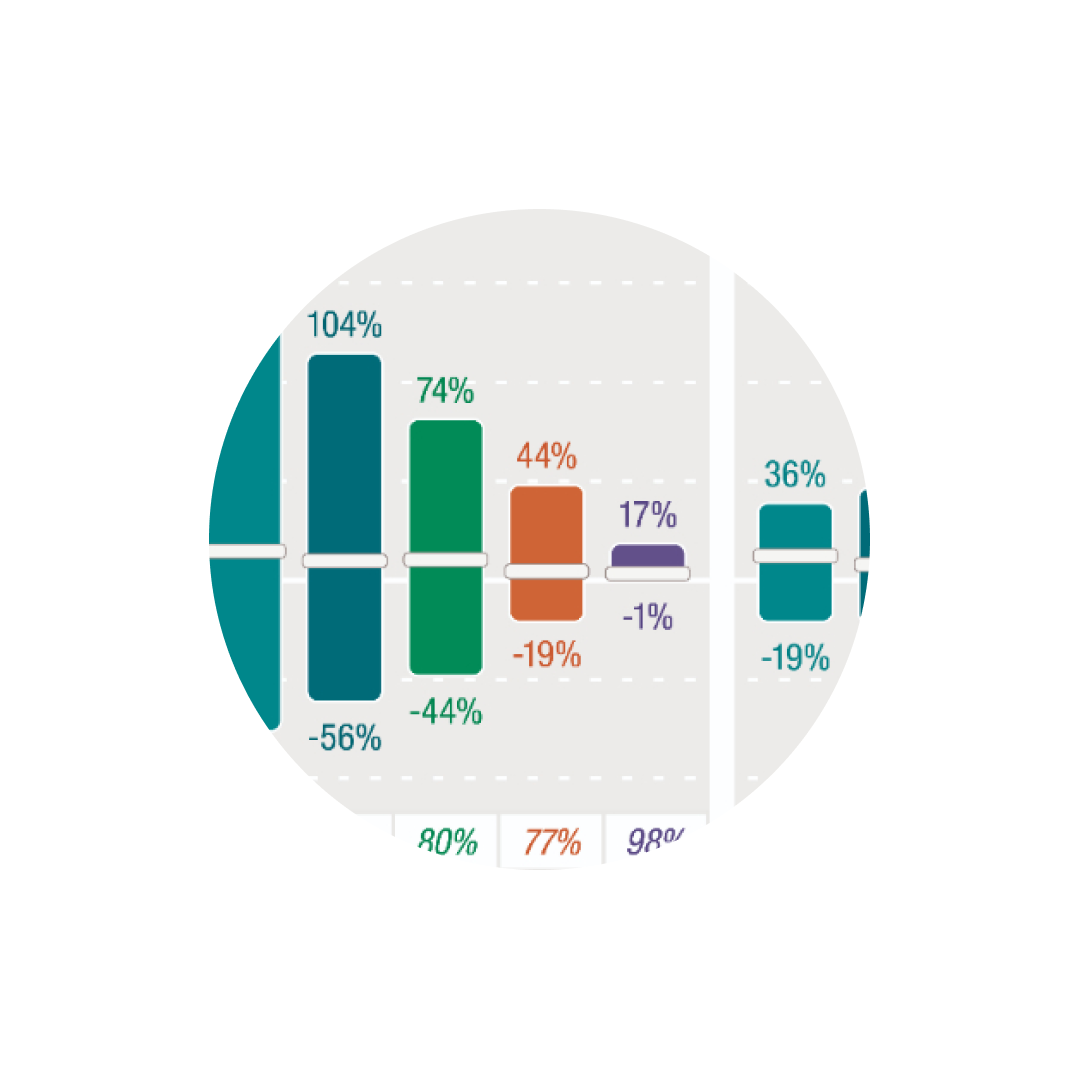

Risk & Return

Stocks have historically outperformed, but with higher volatility. Balanced portfolios offer a smoother ride during downturns

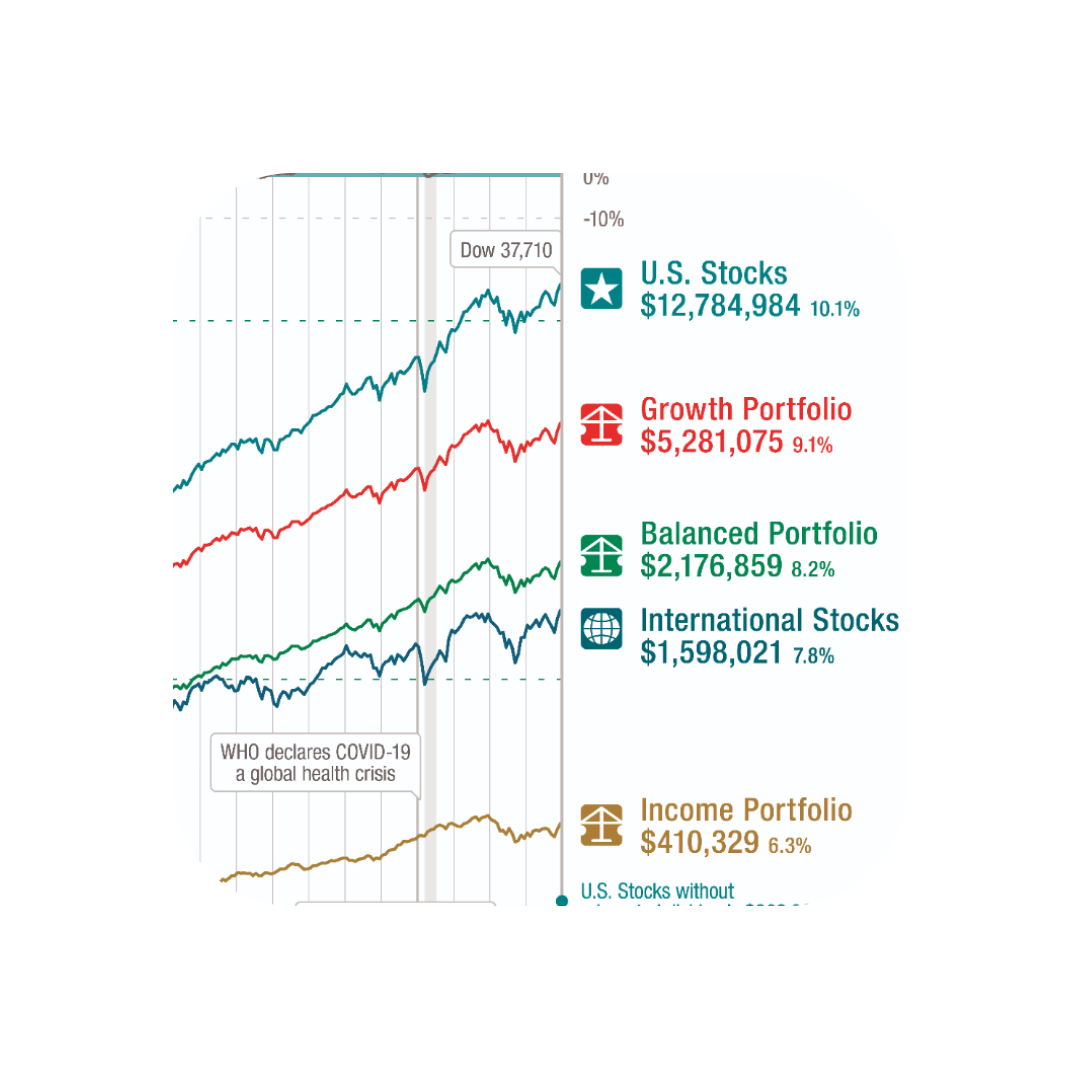

Staying Invested

Despite 16 recessions and numerous crises, U.S stocks have turned $1 into $12,000 over the past century

Historical Context

From recessions to oil prices, global events shape market performance across all asset classes